Big Deal Small Business: Local vs National Searches

August 2, 2021 | Issue #33

If this was forwarded to you, check out the archive or subscribe below.

The traditional wisdom in search funds is to have no geographic restrictions other than country borders.

It’s understandable — it’s hard enough to find a business to acquire, why limit yourself to one city or region?

Further, if you’re trying to find a diamond in the rough, it seems logical that you should be searching in the rough to begin with aka regions that are historically less popular with searchers.

Traditional searchers often hail from the coasts, partially due to Stanford & Harvard being the two focal nodes of search funds. But there is also more capital available out of major cities along the coasts as these are major hubs of individual wealth creation between Silicon Valley in California and Wall Street in NYC.

As a result, there tends to more competition for deals in major coastal hubs. Being willing to step out into regions less trafficked by acquirers can be a competitive advantage. You may be able to acquire a business at a cheaper multiple.

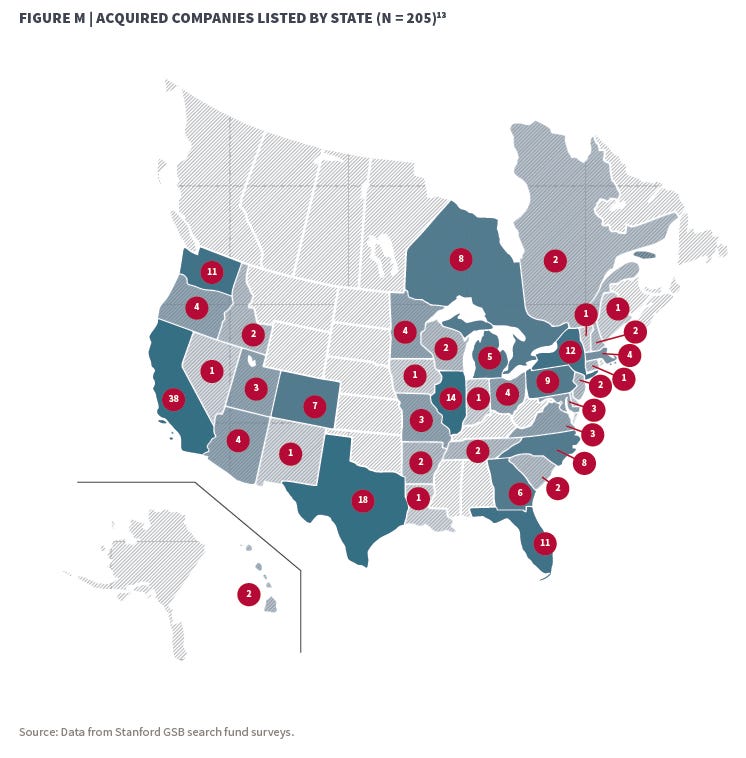

The Stanford search study shows a fairly diverse set of acquisition locations (n=205):

Roughly 50% of the acquisitions were in “major coastal states” which I loosely defined as WA & CA on the West Coast and MA, NY, PA, NJ, MD, VA, NC, GA, and FL on the East Coast. (Don’t email me if you’re from CT/RI, they’re NYC/Boston suburbs masquerading as states and you know it).

Texas & Illinois make up a big chunk of the middle of the country acquisitions, but there is still a healthy mix of other states (though a strange gap in the Great Plains).

So if the traditional searchers are largely doing nationwide searches, where does that leave self-funded searchers? We’re generally worse-capitalized and have less time to focus on search…so what’s the best approach for us?

Going Local / Regional

My thinking has evolved a lot on this — when I started searching, I assumed I’d buy a business within an hour of major coastal city. I’ve always lived in urban/suburban areas and am most comfortable in that environment.

As I learned more about the space, read the Stanford primer, spoke to traditional searchers & investors, I decided that a national search is the way to go.

Now that I’m a full year into search, I’ve changed my tune back to where I started. I’m focusing on major urban areas on the West Coast & Northeast that have technology companies (as well as places like Denver that have a similar makeup & vibe).

There are three reasons I’ve settled back on a regional search:

Personal lifestyle

Competitiveness as an acquirer

Competitiveness as an operator

Personal Lifestyle

As a self-funded searcher, my goal is not to do a 3-5 year deal and then move on. The benefit of a self-funded deal is a cap structure that is naturally structured around a longer-term hold. My hope is to buy a business and grow its intrinsic value over 30+ years.

As a result, I want to think about my deal in decades, not years — this means thinking about where I’d want to raise a family, where my girlfriend can easily find a job, where we’d fit in culturally, etc.

As someone who 1) grew up in a major tech city (Seattle) and 2) has a girlfriend who is a software engineer, and 3) has all his family in coastal cities — the idea of moving to a rural area / non-tech hub is not a decades-long play. It would be manageable for a few years, but my personal lifestyle would be at odds with the business.

This is unhealthy for me and for my relationships with the most important people in my life.

But it’s also not good for my investors — my capital allocation & operating decisions should not be impacted by the region. I’ll be the best steward of their capital when I’m in my “natural habitat” and comfortable with putting down long-term roots.

To make this more tangible — I got comfortable with my Alaska deal because it was a seasonal tourism business, so after a year or two of full-time Alaska living, I could very reasonably live in the lower 48 for 7-9 months of the year.

However, whenever I contemplated add-on acquisitions or new services for that business, I was always thinking about new geographies. In reality, the best decision may have been to build out a winter tourism business in Alaska to leverage the existing business ties in that community.

But I didn’t want to live in Alaska in the winter — in that sense, my capital allocation decision would have been impacted by my personal lifestyle preferences.

(It still would have been a good deal and I’m still salty that the deal died, but just an honest reflection on my mentality around that deal.)

Note — this is written from my personal perspective — it’s not meant to be prescriptive as to where you should focus. It’s not meant to pass value judgements on the best places to live. It’s just explaining why my personal realities have pushed me to re-focus on West Cost/Northeast tech hubs even though they are more competitive places to buy a business.

Competitiveness as an Acquirer

When you find a good deal, it’s unlikely you’re the only one. You usually need to beat out other acquirers.

Having local knowledge or a good “story” around your connection to that space are real competitive advantages in an auction.

For example, when I look at businesses in the Seattle area, I know way more about the target company’s service area than a national searcher. I know what it means to be operating in the Everett area versus the Eastside versus Seattle proper.

As I spoke about in my Finding Your Edge post, you need a good reason to win a deal (otherwise you probably overpaid). Being local can be your edge.

Similarly, I have found Sellers like to hear that you went to a high school they recognize or that you have ties to the community that show you’re a long-term oriented.

Further, if you want to do add-on acquisitions to grow inorganically, the reality is that the best pipeline will be in the same region as your first deal. People will hear about your fist deal and come to you with more leads. If you’re not interested in doing the next couple deals in the same region, it’s wasted opportunity.

By the way — if you come from a non-coastal hub & search in your hometown / region, you get the benefit of being local AND having lower competition in your region.

Competitiveness as an Operator

Setting aside how personal preferences may impact operating decisions (discussed above), being local & putting down long-term roots is a business advantage as well.

Putting down long-term roots means buying a home, having kids in the local school, joining community organizations, volunteering/donating to local non-profits, etc.

While seemingly intangible, these actions provide powerful signal to employees & customers alike that you are reliable and here for the long haul.

As a small business operator, one of your competitive advantages versus big businesses is local knowledge & relationships. If you’ve got one foot in & one foot out of the region, you’re abdicating or at least diluting that edge.

Further, as you grow your business, you will have to attract & retain great people, sometimes from out of state or out of town. If you don’t intend to live in the area long-term, it’s that much harder to convince others that they should commit to the area & business.

Conclusion

This was all a long-winded way of saying that I think self-funded searchers should not shy away from limiting their geographic focus. It may seem like you’re making your search harder, but my hypothesis is that you’ll likely end up happier and more financially successful.

As a result, I’m focused on where I know best and where I can build a long-term life while delivering great returns to my investors.

I’m sure some of you disagree on limiting search to regional — let me know why. Hit reply to this email or find me on Twitter.

Thanks,

Guesswork Investing

P.S. I’d always appreciate introductions to potential acquisition targets or brokers (primarily targeting $750K-$1.5M+ of SDE or EBITDA, ideally located in the Northeast, West Coast, or Colorado).