Big Deal Small Business: Results of Deal Cost Survey

July 16, 2021 | Issue #29

If this was forwarded to you, check out the archive or subscribe below.

Only one newsletter this week as the tyranny of my day job has won out over my desire to write newsletters.

That said, I finally got around to compiling the results of the deal cost survey. First of all, big thank you to the 16 folks who submitted their deal costs. It’s a great contribution to the collective learning pool of SMB searchers.

I’m doing limited editorializing in this post, mostly presenting the results as I found them. Note that I left the survey reasonably open-ended to improve response rates, so it’s would be inaccurate to say this was a scientific poll. But hopefully it gives my fellow searchers a directional sense of what it costs to get a deal done.

Let’s dive right in!

Headline Numbers

Median Revenue: $5.50 million

Median EBITDA: $1.35 million

Median Price: $4.05 million

Median Multiple: 3.5x (hell yeah, nicely done!)

Median deal cost: $70K

Median deal cost as % of purchase price: 2.0%

Stock vs Asset Deals

11 of the 16 deals were asset purchases, the other 5 were stock purchases. Stock purchases tended to be bigger, with a median EBITDA of $1.5 million and purchase price of $6.5 million.

Despite the size and complexity of stock deals, their median deal cost was also 2.0%. In fact, of the 5 deals that were >3% in deal fees, only one was a stock purchase.

Honestly, I’m not sure what to make of that — in my mind, a stock deal has all the diligence of an asset deal, but then you also have to do full Legal DD given you’re inheriting the known & unknown liabilities of the business.

The answer is not deal size — from my sample set, bigger deals didn’t have a lower % of deal costs (again, a bit of a head scratcher).

Diligence Process

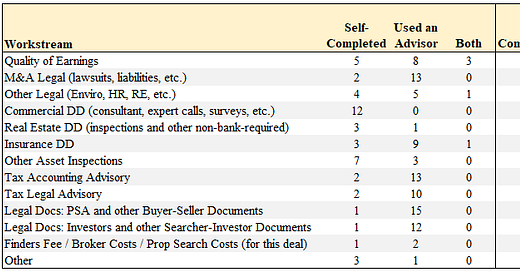

Nothing too surprising in these results, though I think it does show the range of searcher profiles. Only one brave soul did all legal docs themselves, while many are comfortable handling QoE completely on their own.

Big Ticket Items: QoE

The only two workstreams that were 16/16 above were QoE and Legal Docs (PSA & other Buyer-Seller Documents), so I spent more time focused on those costs.

For the 11 searchers that used an advisor on QoE, they paid a median of:

$40,000

1.86% of EBITDA

0.44% of purchase price

There was a real range here: a few that were more of a QoE-lite and <$10K, and the rest in the $20-$50K range for a full-blown QoE.

Just lobbing in my personal experience, the cost of the QoE can vary dramatically based on the scope. Read your the proposed engagement letter carefully, cross of things you don’t need, then ask for a re-quote.

I asked the respondents about their “dead deal discounts” to the extent they were pre-arranged. Most did not respond, but two said 50% and one said 25%.

In my experience, some CPAs are okay with 50% upfront & 50% at closing (if the deal closes). Hard to know what trade-off you get on service for that kind of deal, but it’s worth considering.

Big Ticket Items: Legal (PSA & Other Buyer-Seller Docs)

Searchers paid between $350 - $500/hour for their legal work. They generally worked with teams of 1-2 lawyers (including partners & associates), though a couple worked with larger teams. One searcher negotiated a flat rate for all legal work, which could be an attractive alternative.

Ignoring the brave soul who did his own legal work, the other 15 searchers spent between $10K and $80K on legal docs, at a median of $28,500 and 0.67% of purchase price.

There were a couple dead deal discounts mentioned here as well, but don’t have a lot of color to share there.

Pearls of Wisdom

I left some space for the respondents to pass along some thoughts. Here are a couple (paraphrased / redacted / combined for duplicative thoughts):

It’s an absolute grind. Especially when you come from a different environment when you have team support. Doing all the little things yourself…with a bit of help from advisors gives you a new perspective.

Discuss treatment of dead deal costs with advisors in advance to set clear expectations. Define lender QofE requirements and don’t overpay for a brand name if a smaller firm will do the work (exception: relevant industry experience helps). Work with an experienced law firm partner who will do the work themselves and not run the clock multiple times with an associate on calls. Ask lender / investors for recommendations to advisors who already work with searchers (flexible on dead deal costs, efficient with time, know what matters). Don’t be overly frugal: if you need the two hours with your attorney, use them. Advisors can add much more value than their hourly cost.

Just only do what is truly necessary. You don’t need a full Q of E on a sub-$1M SDE deal unless the accounting practices are suspect.

Ask for fixed fee agreements vs hourly. Consider success payment at deal closing for legal.

A good advisor is worth much more than they charge you, and a bad one is much more expensive than their rate.

Roll as much into loan as possible. Pay the rest post close.

Used LP contacts for legal / accounting work so closing costs may be lower

Conclusion

Only one post this week but hopefully this one was worth 2 posts and worth the price of admission (free).

This survey confirmed for me that 1) good advisors cost real money and 2) you have to budget for good advisors.

If you’ve got thoughts to add on how you manage deal costs, I’m all ears. Just hit reply to this email or find me on Twitter. If you think this would be helpful to fellow searchers, please share with them or post on Twitter.

And of course, thank you again to our respondents.

Thanks,

Guesswork Investing

P.S. I’d always appreciate introductions to potential acquisition targets or brokers (primarily targeting $750K-$1.5M+ of SDE or EBITDA, ideally located in the Northeast, West Coast, or Colorado).

Super helpful (like all your posts) Thanks!