Big Deal Small Business: Using a CRM in Search

(Note there are several screenshots below, so you may need to “download images” to see them.)

Today’s post shows how I use a CRM to manage my search process. It’s blocking & tackling, but has been fundamental in managing a search process while keeping a day job.

Search involves constant deal reps — you never know which deal is going to click. I have to keep up consistent deal volume over a long period of time given the low odds of closing any one deal.

A CRM makes sure I don’t allow deals to stagnate, whether its my fault or the broker’s fault.

My approach is low frills and low tech. I use Pipedrive, but Hubspot or any of the other low-cost CRMs would work fine. I don’t do any proprietary outreach at this stage, everything comes in via brokers.

I may have 2-10+ deals “live” at any given moment. Each deal moves at its own pace, so attempting to manage the # of deals in my funnel is a lost cause.

Instead of managing the funnel to a fixed # of deals at a time, I use the CRM to make sure I don’t drop the ball on any given deal. The brokers & sellers will move at their pace, but I never want to be the reason a deal process dies.

To solve that, I use two core features of the CRM:

Deal Pipeline

Activity List

Deal Pipeline

When I add a new deal, I fill in as many of the below fields as possible:

The basic info is obvious, but the metrics are helpful for reviewing my deal activity.

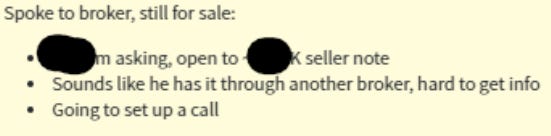

It takes getting used to, but I try to take quick notes after each broker conversation or document review. Given the volume of deals I’m reviewing, it’s easy to have “deal merge” or just forget important details. My notes have saved me many times.

These notes are usually quick jots after a call or CIM review (apologies for my sloppy redaction work):

At the other end of the deal lifecycle, I select a reason the deal died and write a one-liner explaining what happened. Examples below:

As deals progress, I move them through a pre-defined list of stages. You can create a custom pipeline flow in any CRM, but this is what mine looks like:

As I improved my process, I flipped the order of Valuation Discussion and First Stage of Work.

As I’ve progressed in my search, I’ve found it makes more sense to have a valuation discussion before a long management meeting or diligence Q&A. This helps kill low-probability deals before I spend the time & effort on the first stage of work.

A deal will start “rotting” if it hasn’t moved out of the pipeline stage in X days (see icon of bell with day count in the image above).

To stop a deal from rotting, I have to do one of three things: 1) progress it to the next stage, 2) kill the deal, or 3) define a new activity for the deal. I’ll discuss #3 below.

Activity List

Defining the next activity is how I maintain deal momentum. My experience is that brokers consistently forget about me. We may have had a great call, even agreed on follow-ups, but they still go radio silent for weeks.

On every touchpoint with the broker (call or email) I try to be explicit about the next step. But at the same time, I enter a “follow up with broker” activity into the CRM for that deal with a deadline 2-3 days in the future.

The CRM reminds me to follow up on the deadline day, so I send a follow up email to the broker and then reset the follow up activity for another 2-3 days. At some point you just kill the deal if the broker won’t engage. But this practice ensures your deal pipeline doesn’t rely on the broker to stay on top of things.

If the broker actually completed their task and the ball is in my court, I set realistic deadlines for myself based on my work schedule for a given week. I’m not trying to jam myself everyday with work, it’s just to make sure nothing gets missed. My current activity list looks like this:

If I received a CIM at 10pm and I just worked a 14 hour day, I’m probably not reading that CIM the same night. It takes 30 seconds to enter an activity into the CRM to read the CIM in the next 2 days, but that can be the difference between dropping the ball and not.

A typical process looks like this:

Sign NDA

Receive CIM, enter New Deal into CRM, enter activity to review CIM

Review CIM, send ask for call with broker to go through basic questions and hear deal backstory

Enter activity to follow up with broker

Follow up with broker, update activity to follow up with broker for 2-3 days further

Broker responds, set up time to talk, enter the planned call as an activity on CRM

Get questions answered on the call, broker asks for an IOI before setting up management meeting

Jot down notes from call, enter activity to send IOI to broker

Send IOI to broker, move deal from Initial Information Review to Valuation Discussion, enter activity to follow up with broker

Broker responds favorably, plans to set up management meeting

Enter activity to follow up with broker on mgmt meeting scheduling

And so on…

It’s a habit that feels silly/overkill 80% of the time, but pays dividends the 20% of the time that I’m burning the candle at both ends due to work conflicts, personal life, etc.

Conclusion

Remember, you only need one deal to close, and you have have no idea which one it will be. Having a system like the above ensures you don’t let that one deal slip through the cracks.

That was in the weeds, but hopefully a helpful rundown of how I use a CRM to manage my search process. If you have further suggestions / best practices I should consider, I’d love to hear them.

Just hit reply to this email or DM me on Twitter.

Thanks,

Guesswork Investing

INCREDIBLY appreciative of this blog post. Bless you for publishing this!

Great post and idea. I'm going to try to set this up in my Notion Database and implement something similar.