Big Deal Small Business: Quality of Revenue (Updated)

February 21, 2023 | Issue #79

As mentioned in the last post, I’m editing & updating some of my older posts to reflect my latest thinking on the topics now that I’m much further into search.

When I started writing this newsletter, I was coming at it from 100% PE-style investment analytics. I now have the context to make it a bit more SMB-relevant.

Every searcher says they want recurring revenue. Today, I want to dig a level deeper into defining what is & is not recurring revenue. When I was searching, I didn’t have a hard line in the sand in terms of minimum % of recurring revenue to buy a business (and surprise, I bought with with close to zero recurring revenue). But regardless of your deal filter, it’s crucial to understand what type of revenue you’re actually buying.

There are some Excel outputs below, so please make sure to select “download pictures” or whatever your email client requires so the images load.

Why does it even matter?

Revenue quality is a meaningful driver of decision-making in business operations and financial outcomes when it comes to capital raising & valuation.

In operations, more predictable revenue allows managers to re-invest in their business with confidence. If you know your next 12 months of revenue are locked in with 90% confidence (aka your retention rate), you can more easily make an investment for next year without worrying about if you’ll have enough cash rolling in while you wait for the ROI on the new investment.

This makes higher revenue quality businesses easier to operate and easier to grow. I’ve explored this concept in more detail in another post linked here (fair warning, this post was met with mixed reviews…your mileage may vary on this one).

Further, in a sale context, the ownership transition creates meaningful disruption risk. If customers have no purchase decision to make, they’re less likely to notice or care about the sale process at all. Revenue disruption is far less likely during that transition period.

There are meaningful valuation benefits as well. At its core, a lower volatility, more predictable business is intrinsically worth more for two reasons.

First, a more stable business can support a higher level of debt because lenders have more confidence in your cash flow stability. Debt is less expensive than equity, so the more debt a business can support, the more valuable it becomes (for the finance nerds among us, higher debt capacity = lower WACC = higher NPV) as it requires less equity.

Second, just as debt is more available, equity capital should also be more available for a predictable business, which has the effect of lowering the cost of equity also. Again, this increases business value.

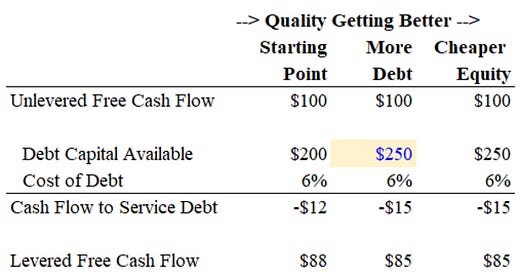

I’ve laid out those two concepts in the table below:

(Image of a bunch of math should be showing up here)

Most business owners know this intuitively, but I find laying it out quantitatively can be powerful. Each column shows a business with $100 of free cash flow, but different levels of revenue quality. As you move up in revenue quality, the valuation multiple increases from 4.5x to nearly 6x.

In conclusion, the higher revenue quality, the higher multiple it should command.

What is revenue is higher quality?

Okay, so let’s agree that we should want higher quality revenue — that’s why everyone says they want recurring revenue. But how do we assess what kind of revenue we actually have?

Recurring Revenue

In my view, revenue is only recurring if there is no customer decision to be made each time they send you money. The revenue tends to be disconnected from the product or service provision.

Now obviously, if you stopped providing the service, the revenue would dry up eventually. But in any given month, the revenue rolls without any thought on the part of the customer and regardless of what happens on the cost side of your P&L.

The best example of this is software products like Salesforce - the customer autopays their bill every month, regardless of how much they used the platform in that given month. No decision was made to pay the bill either, it’s just on autopay.

People love SaaS businesses for this reason, but make sure you understand the revenue model. A $50/month SaaS business is very different than a SaaS product that charges per transaction or per event (such as Twilio).

Re-Occurring Revenue

Re-occurring revenue involves having a steady client base that makes repeat purchase decisions in a predictable manner.

Car insurance premiums tend to be recurring revenue on a monthly basis and re-occurring revenue on an annual basis at renewal time. By contrast, an internet subscription is a true recurring revenue business both monthly and annually.

A pool chemical supplier is a re-occurring revenue business if the customer comes in each month to refill on chlorine; it’s a recurring revenue business if the chemicals are automatically shipped to the customers each month.

A landscaping maintenance contract in the Boston suburbs might be recurring monthly in the summer, but may require a purchase decision at the start of each season. On the other hand, a landscaping maintenance contract in Florida might be recurring indefinitely.

One-Time Purchases

Lastly, one-time purchases are those where a customer makes a single purchase and is unlikely to re-occur in any predictable manner.

Capital equipment, say a factory buying a specific piece of machinery or a homeowner replacing their roof, are one-time in nature for any given year, but are likely re-occurring on some defined deprecation schedule. A business with a sufficiently large base of clientele over enough years can end up having predictable revenue even if each purchase is one-time in nature.

By contrast, a high-end vacation tour package company in Alaska is probably the only time the customer will ever make that purchase.

Summary

My framework for quality of revenue, from least to best (ST = short-term and LT = long-term) with examples within a single value chain:

One-Time: Pool Installation

One-Time ST, Re-Occurring LT: Pool Repair, Water Filter, Pool Toys

Re-Occurring ST: Pool Chemicals

Recurring ST, Re-Occurring LT: Pool Maintenance Annual Contract

Recurring ST & LT: Water Utility

Value Creation Opportunities

We’ve now identified why revenue quality matters and how to identify it. The last step is understanding how improving revenue quality can grow your business. Not grow revenue, but grow your equity.

In diligence, I am focused on identifying ways to move the target business up the revenue quality curve.

For example, the first deal I looked hard at was a tour operator in Alaska. This was the lowest revenue quality as a one-time purchase type of service (though it had 12-month forward commitments with cash deposits, so you were able to re-invest in the business with confidence and negative working capital).

I looked at national tour operators and found they do 35-40% re-occurring business because if someone has a great trip with them, they are much easier to sell a second trip to a new location.

The Alaska business had only one destination, so nothing new to sell. My strategy would have been highly focused on buying a second tour operator in a new location to create that repeat sale opportunity.

Below is a quantitative example of how powerful that strategy can be. Let’s start you spend 8% of revenue on the cost of selling (email marketing, salespeople, PPC, etc.). Now let’s assume we get just 10% of customers to repeat to the second location – these people have already been “sold” once, so the cost of selling them the second time is far lower.

Let’s say the sales cost is 2% of revenue on repeat sales (just costs related to re-marketing to existing clients), but all other costs are the same for the actual tour provision.

(Image of a bunch of math should be showing up here)

As you can see above, turning 10% of the second businesses sales into repeat business at 2% cost of sales vs 8% ends up driving 1.2% cash flow growth despite no revenue growth.

That’s just step one.

Step two is the valuation impact. As we discussed at the very top of this post, repeat business deserves a higher multiple. So let’s look at our business value before and after introducing 10% repeat business.

(a bunch of math should be showing up here)

As you can see above, a 0% growth in revenue translated into a 1.2% growth in cash flow, and the improving quality of that cash flow drove an incremental 2.1% growth in business value. In total, you’re up 3.3% on business value.

Lastly, let’s say you have $100 of debt on the business. Once you subtract that from business value, you’re left with equity value.

As you can see below, the 3.3% increase in overall business value translates to nearly 6% growth in your equity value – again, purely driven by improving your revenue quality, no actual growth in the business.

Conclusion

When I was searching I was focused on 1) understanding revenue quality and then 2) looking for opportunities to improve revenue quality. I find most searchers talk about their plans to grow the business; remember, the goal is to grow equity value, not just revenue. Improving revenue quality can be a powerful way to drive value irrespective of growth.

Thanks,

Guesswork Investing

Very useful info, thanks for sharing it.

Great information. Thank you.