Big Deal Small Business: Revenue Quality (Again)

December 10, 2022 | Issue #76

Revenue Quality is clearly one of the most important elements of assessing business quality & downside risk.

I’ve written before about revenue quality, though that time I focused on defining it and how it impacted business valuation & cash flow.

But as I run my own business (which is primarily re-occurring revenue on a 2-5 year buying cycle), I think I missed explaining how different each type of revenue can “feel” when you’re running it. Specifically, whether your business feels like it “wants” to grow naturally, or if you have to will it to grow with ad spend & effort.

Today’s post is a bunch of math walking through that to hopefully turn these concepts into an intuitive muscle in your business diligence toolkit. That’s why it’s a weekend post; grab some coffee.

But first! A quick shout-out for SMBash (I’ll be attending as well!):

SMBash is back! This year’s event is April 27th – 30th 2023, in Austin, TX. If you want to build deep connections with folks in the acquisition entrepreneurship community, join us for three days at 800 Congress in downtown Austin. Just like last year, the event includes panel conversations, live podcast recordings, phenomenal meals, entertainment and MUCH more. Snag your ticket at www.smbash.com.

Hope to see a lot of you there!

Side-by-Side Comparisons

Below I have laid out three businesses:

Business A has recurring revenue

Business B has re-occurring revenue that repeats every 2 years

Business C has one-time revenue

For each business, I used the same sets of assumptions:

Annual customer churn is 10% (except for Business C, which is 100%)

Each increases prices by 5% annually

Each has the same Customer Acquisition Cost ("CAC") of $250/customer

Each has the same starting out base of 100 customers spending $1,000/year, so $100K of revenue (one minor adjustment; for Business B, I assume there is a 2021 cohort that repeats in 2023, otherwise it's unfairly punitive).

We then track how each business evolves over the ensuing 3 years.

I ran two scenarios:

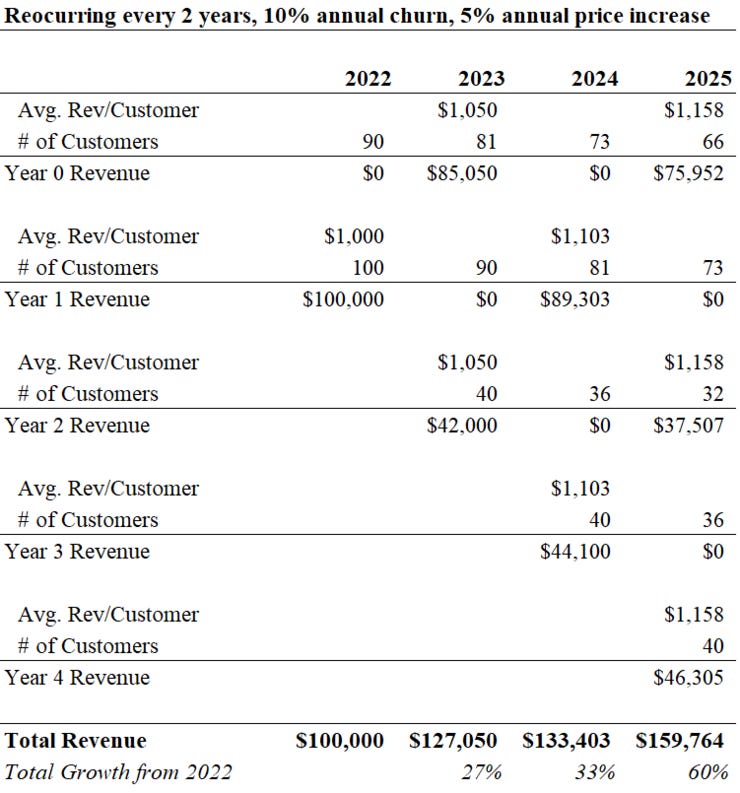

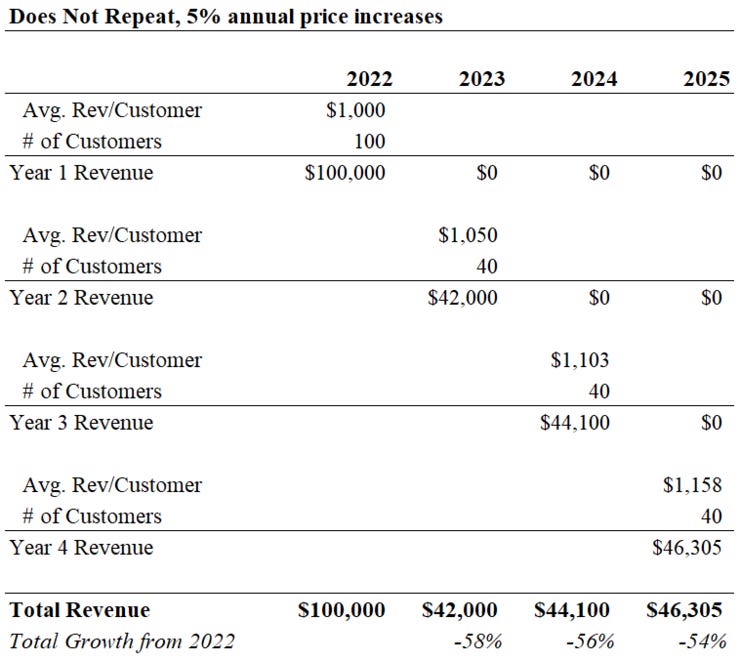

Revenue Growth Example: I assumed the same marketing spend for each business of $10,000/year, which buys 40 customers at the $250 CAC, and we see how each business grows.

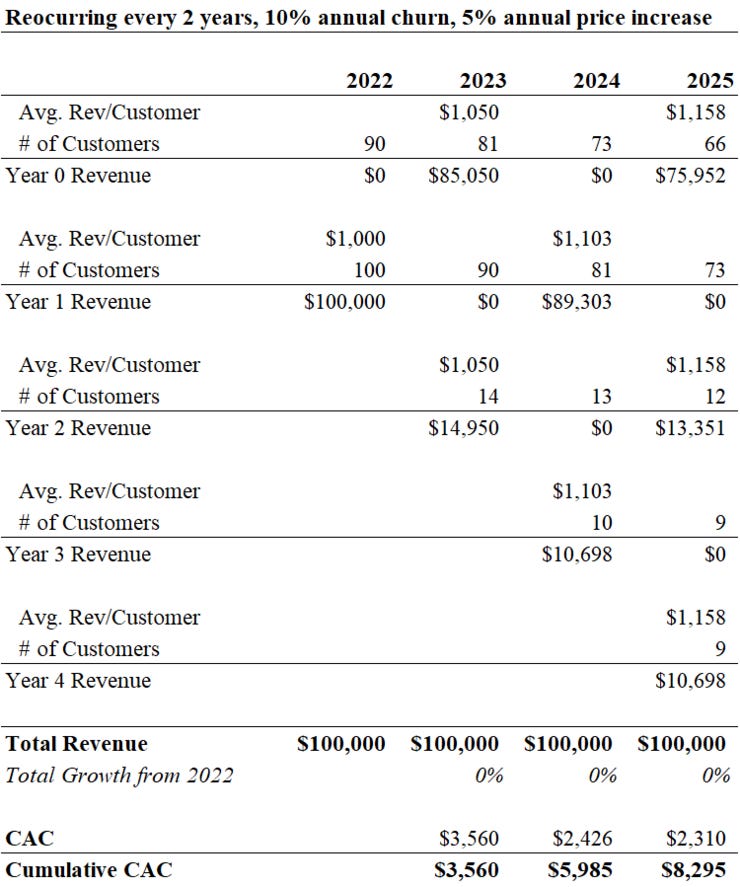

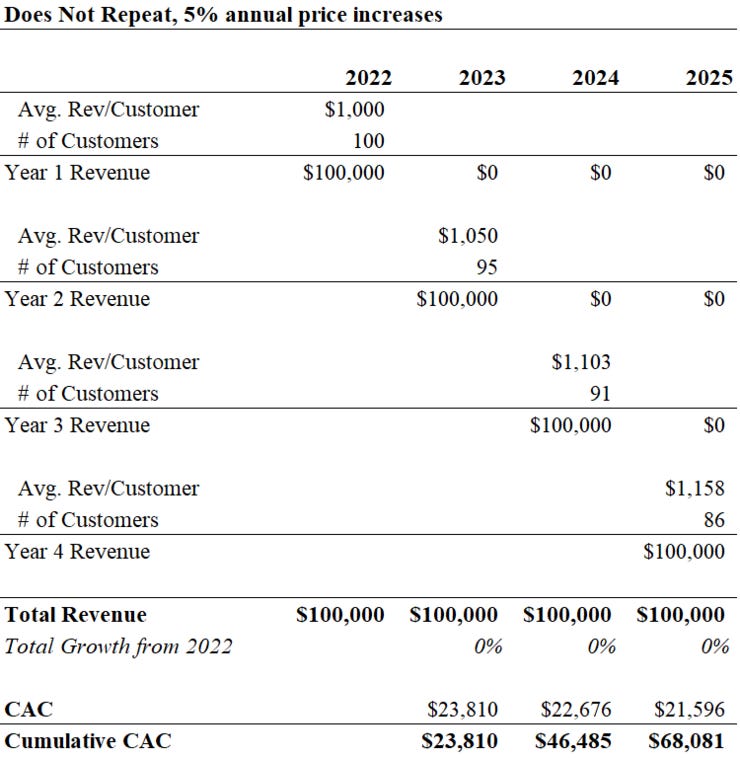

Revenue Constant Example: I solved for sufficient ad spend for each business to hold revenue flat, and we see how much ad spend that takes.

Got it? Let's dive in.

Revenue Growth Example

The recurring revenue business more than doubles revenue in 3 years by spending $10K/year on ad spend.

The re-occurring or repeat revenue business grows in fits & starts, which makes it a harder business to operate (hard to know when to invest in more capacity), but still grows nicely. This would also get smoother over a longer term with more customer cohorts.

The one-time, non-repeat business gets hammered, down 54% if it only spends $10K/year on ad spend, the exact same amount as both businesses above.

To summarize, spending the same ad spend for each business results in strong steady growth for recurring revenue, solid but inconsistent growth for re-occurring revenue, and 50% decline for one-time revenue.

Revenue Constant Example

The recurring revenue business spends under $4K on ad spend cumulatively over 3 years to hold revenue flat. That's only 1.2% of revenue over those 3 years.

The re-occurring or repeat revenue business spends a little over 2x the ad spend to hold revenue flat; it needs to spend ~$8K over 3 years, or 2.8% of its 3-year cumulative revenue.

The one-time, non-repeat business has to spend another 8x of the re-occurring business on ad spend, or nearly 18x the recurring revenue business ad spend, just to hold revenue flat! That's $68K over 3 years, or 22.7% of cumulative revenue.

To summarize, to hold each business flat, you have to spend 1.2% of revenue on ad spend in a recurring revenue business; 2.8% of a re-occurring revenue business; 22.7% of a one-time revenue business!

Make sure your deal models properly account for that ad spend when you assume you'll grow at X% per year...

Counterpoints

To be clear, these are HYPER-simplified models meant to illustrate a point. They ignore a lot of real life dynamics, such as:

Recurring revenue requires account management, which one-time revenue does not. Each salesperson can spend more time on new sales in a one-time setting.

It may be easier to pass price increases in a one-time or re-occurring setting than recurring, unless the recurring product/service is very difficult to switch out of for clients.

Each sale may be tougher for recurring revenue businesses given the buyer is making a recurring expense decision.

Tons of nuance that the simple math above glosses over. You can have success in all forms of business; I would categorize the "point" of this newsletter as "Are you sure you understand the game you're getting into?", not "This is the game you should get into!"

To that end, I ran this newsletter post by a friend who owns a very successful business with re-occurring / one-time revenue; he raised all the above counterpoints & more.

(So then I ran it by another friend who operated a recurring revenue business, he confirmed my biases, so I'm posting it anyway...)

Conclusion

Searchers sometimes wonder why investors are so zealous about focusing on recurring revenue businesses. It goes beyond just ease of underwriting and lower downside risk. It's a structurally different growth story & operating story. My business is more in the middle camp, but I'm trying to make it more recurring over time.

I want fellow searchers to have a very visceral, gut sense for why recurring revenue is valued so much more highly -- hopefully these simple examples illustrate that clearly.

Feel free to reach out if anything is unclear or seems off to you. Just reply to this email or find me on Twitter.

And one more shout-out for SMBash, hope to see you all there in April!

Thanks,

Guesswork Investing